---------- Forwarded message ----------

From: Rude Awakening <rude@agorafinancial.com>

Date: Mon, Jun 30, 2014 at 7:08 AM

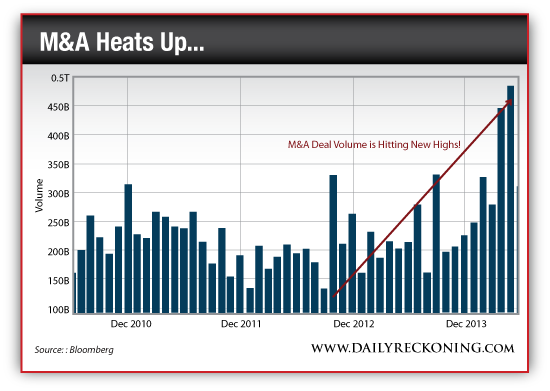

Subject: How to Access a $1 Trillion Market

To: iammejtm@gmail.com

From: Rude Awakening <rude@agorafinancial.com>

Date: Mon, Jun 30, 2014 at 7:08 AM

Subject: How to Access a $1 Trillion Market

To: iammejtm@gmail.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rude Numbers | ||||||||||||

| Targets, Predictions and Wild Guesses | ||||||||||||

| ||||||||||||

| Rude Trends | ||||||||||||

| When to Buy... When to Sell | ||||||||||||

| The S&P 500 is up a little more than 6% year-to-date as we officially approach the halfway point of 2014 today... But a quick check up on the professional "stock pickers" shows that most of the pros have failed to hit this modest benchmark. In fact, Morningstar reports that so far this year, more actively managed mutual funds are trailing their respective benchmarks since 2011. "In some cases, the gap is stark," The Wall Street Journal notes. "More than 74% of actively managed funds that invest in shares of big U.S. companies are lagging behind the S&P 500 index, up from 50% last year. It is the second-worst performance on record going back to 2004, according to the fund researcher. The story is similar across many categories of funds investing in small- and midsize stocks." So almost three out of four actively managed funds isn't living up to expectations. That's crazy. But it's really nothing new. Many of the pros have had a lot of trouble trying to figure out the market--even though stocks have mostly churned higher since the 2011 eurozone correction. Thankfully, you have a simple formula you can use every single day to help rake in the gains. Instead of trying to outsmart the market, you should follow the trends. It's really that simple. So how can you continue to beat the pros at their own game during the second half of 2014 and beyond? Find the best trends and get onboard. Don't let news event and other distractions shake you out of winning positions. Cut your underperforming positions. And most importantly, learn that the market is the boss. Price doesn't lie. At the end of the day, that's all that should matter to you (and your brokerage account). [Ed. Note: Send your feedback here: rude@agorafinancial.com - and follow me on Twitter: @GregGuenthner] | ||||||||||||

| Ignore At Your Own Peril | ||||||||||||

| Today's Must Read Links | ||||||||||||

| BE SURE TO ADD dr@dailyreckoning.com to your address book. | ||||||||||||

| Additional Articles & Commentary: Join the conversation! Follow us on social media: | ||||||||||||

| The Rude Awakening is committed to protecting and respecting your privacy. We do not rent or share your email address. By submitting your email address, you consent to Agora Financial delivering daily email issues and advertisements. To end your Rude Awakening e-mail subscription and associated external offers sent from The Rude Awakening, click here. Please read our Privacy Statement. For any further comments or concerns please email us at rude@agorafinancial.com. If you are you having trouble receiving your Rude Awakening subscription, you can ensure its arrival in your mailbox by whitelisting The Rude Awakening.  © 2014 Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. © 2014 Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security they personally recommend to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of a printed-only publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. | ||

Jeremy Tobias Matthews

No comments:

Post a Comment